Master the Tweezer Top Candlestick Pattern for Trading Success

Imagine having the ability to spot a market reversal with stunning accuracy, empowering you to capture profitable trades while protecting your capital. In the dynamic world of trading, candlestick patterns are essential tools for understanding market sentiment and forecasting price action.

Among these patterns, the Tweezer Top stands out as a powerful indicator of bearish reversals. It provides traders with the insights needed to make strategic, well-informed decisions. Whether you’re working with a regulated forex broker like Opofinance or trading stocks, mastering the Tweezer Top can significantly elevate your trading game.

This guide breaks down everything you need to know about the Tweezer Top candlestick pattern. We’ll cover clear explanations, practical strategies, and real-world examples to help you unlock its full potential. By the end, you’ll be ready to identify, interpret, and trade this pattern effectively.

Understanding Candlestick Patterns in Technical Analysis

Candlestick patterns are the foundation of technical analysis, offering a visual map of price movements over a specific period. Developed by Japanese rice traders in the 18th century, these patterns are now vital tools for traders in forex, stocks, commodities, and crypto markets.

Each candlestick tells a story using four key price points:

-

- Open: The starting price of the asset for the period.

- Close: The final price when the trading period ends.

- High: The highest price the asset reached.

- Low: The lowest price the asset reached.

By analyzing how these points relate to each other, traders can spot trends, pinpoint reversals, and identify optimal entry or exit points. The Tweezer Top pattern is particularly useful for signaling a potential shift from an uptrend to a downtrend.

Why the Tweezer Top Pattern is Crucial for Traders

The Tweezer Top is more than just a shape on a chart—it’s a critical signal of a potential market reversal. Recognizing its importance can give you a strategic edge in anticipating bearish moves and managing your trades.

Here’s why it matters:

- Early Reversal Signal: It alerts you to a coming bearish reversal before a significant price drop gains momentum.

- Better Decision-Making: Using this pattern helps you make more confident decisions about when to enter or exit a position.

- Effective Risk Management: Identifying potential reversals allows you to set smarter stop-loss orders to secure profits and minimize losses.

- Versatile Across Markets: The Tweezer Top is a reliable indicator across different assets, from stocks to forex.

Integrating the Tweezer Top into your strategy, especially when using a broker for forex trading like FXNX, can dramatically improve your ability to trade in volatile markets and boost your overall performance.

What Exactly is a Tweezer Top Candlestick Pattern?

Definition and Basic Explanation

The Tweezer Top is a technical analysis pattern featuring two consecutive candlesticks that have matching or nearly identical highs. It typically appears at the peak of an uptrend, signaling a potential reversal to the downside.

The first candlestick is generally bullish, reflecting strong buying pressure. The second candlestick is bearish and fails to break above the high of the first. This structure suggests that bullish momentum is fading and sellers are starting to take control.

The Meaning Behind the Tweezer Top

The meaning of the Tweezer Top pattern lies in the story it tells about the battle between buyers and sellers at a key price level. When two candles share the same high, it marks a point of resistance where the market’s bullish drive is met with strong bearish opposition.

This push-and-pull dynamic often happens just before a significant downward price move, making the Tweezer Top a dependable bearish reversal signal.

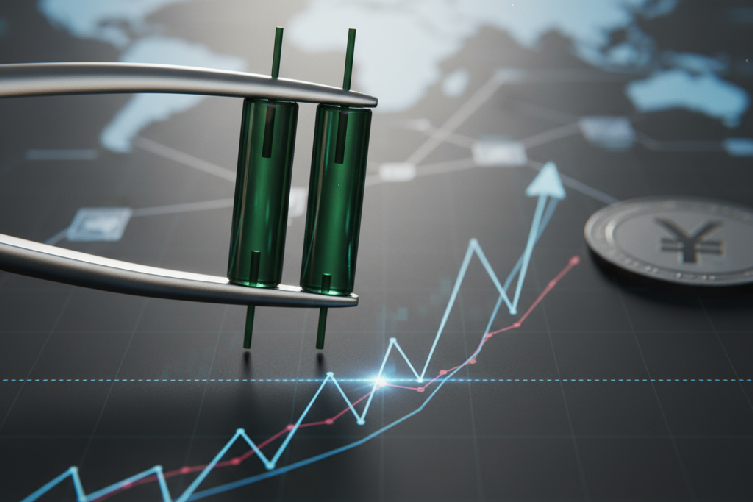

Visualizing the Tweezer Top

Picture two candlesticks side-by-side, with their high points perfectly aligned. This “tweezer” shape powerfully illustrates a stalemate between buying and selling forces. The distinct upper shadows on both candles show that buyers tried to push the price higher but were ultimately repelled by selling pressure.

By recognizing this simple visual cue, you can better prepare for a potential change in market direction and adjust your trading strategy accordingly. Mastering patterns like the Tweezer Top is a key step toward achieving consistent trading success.