Mastering Types of Trends in Forex Trading

Are you ready to unlock the secrets of profitable forex trading? The key lies in mastering the different types of trend in forex trading. Trends form the very backbone of the currency market, and learning to identify them is your ticket to potentially greater success.

This guide will break down the essential trend types in forex. We’ll equip you with actionable strategies to navigate the dynamic world of currency exchange with confidence. Whether you’re a beginner or a seasoned trader looking to sharpen your skills with an online forex broker, understanding trends is absolutely critical.

What Exactly is a Trend in Forex Trading?

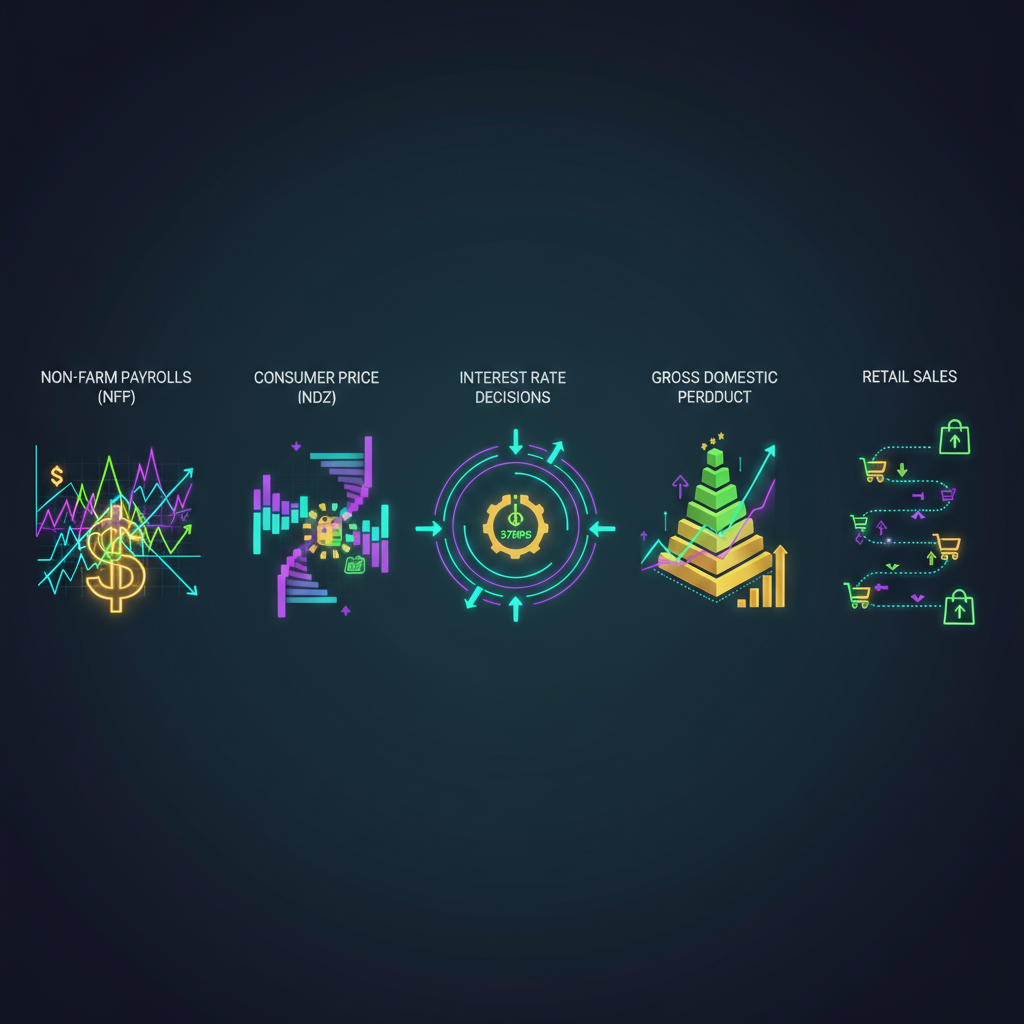

In the forex market, a trend is simply the general direction a currency pair’s price is moving over a period. It’s not just random noise; trends are driven by major factors like global economics, market sentiment, and geopolitical events.

There are three primary types of trend in forex trading to know:

- Uptrend: A market where prices consistently make higher highs and higher lows, signaling strong buying pressure.

- Downtrend: The opposite of an uptrend, where prices form lower highs and lower lows, showing persistent selling pressure.

- Sideways Trend: Also called a range-bound market, this is when prices move within a tight horizontal band, indicating a balance between buyers and sellers.

- Identify Market Momentum: Instantly recognize if the market is bullish, bearish, or sideways to time your trades better.

- Improve Decision-Making: Aligning your trades with the dominant trend increases your probability of success.

- Optimize Entry & Exit Points: Use trends to pinpoint the most strategic moments to enter or exit a trade, maximizing potential returns.

- Mitigate Your Risk: Spotting potential trend reversals early allows you to adjust your risk management and protect your capital.

- Uptrend Strategies: In an uptrend, your focus should be on buying opportunities, particularly during price dips or pullbacks. Look for confirmation signals like a moving average crossover or a bullish breakout.

- Downtrend Strategies: When the market is in a downtrend, you should consider short-selling. Use indicators like the Relative Strength Index (RSI) or MACD to confirm bearish momentum before entering a trade.

- Range-bound Strategies: In a sideways market, range trading is often effective. This involves buying near established support levels and selling near resistance levels. You can also watch closely for a potential breakout.

- Rising Prices: Each new peak is higher than the last, confirming sustained upward movement.

- Bullish Momentum: Strong and consistent buying pressure is present, often fueled by positive economic news or investor optimism.

- Rising Support: A support level forms and follows the price upward, acting as a floor during temporary pullbacks.

- Moving Averages: A classic bullish signal is the “golden cross,” where a shorter-term moving average (like the 50-day) crosses above a longer-term one (like the 200-day).

- Trendlines: Drawing a line that connects the rising lows of the price action provides a clear visual confirmation of the uptrend and can act as a dynamic support level.

Why Trend Analysis is a Game-Changer

Trend analysis is the foundation of successful forex trading. By accurately reading the current trend, traders can make much smarter decisions. Here’s why it’s so important:

When using a broker for forex trading, a solid grasp of trend types helps you choose the right moments to trade, boosting profit potential while minimizing risk.

How Trends Shape Your Forex Strategies

Understanding the different types of trend in forex trading directly impacts which strategies you should use. Tailoring your approach to the market condition is key.

A Closer Look at the Main Forex Trends

Let’s dive deeper into the most common trend type traders look for: the uptrend.

Uptrend: Definition and Characteristics

An uptrend is defined by a series of higher highs and higher lows. This pattern clearly shows that buyers are in control of the market. Its key characteristics include:

Recognizing an uptrend early is a massive advantage, as it allows you to ride the wave of bullish momentum for potential gains.

Key Indicators for Confirming an Uptrend

To confirm an uptrend with more certainty, traders use several popular technical indicators:

By learning to spot these trends and use the right indicators, you can build a more robust and effective trading plan. Mastering the different types of trends is a fundamental skill that separates successful traders from the rest.