Mastering the Tweezer Bottom Candlestick Pattern

Ever wish you could predict a market reversal with pinpoint accuracy, turning potential losses into significant profits? In the dynamic world of financial trading, mastering candlestick patterns can feel like developing a sixth sense.

Among the most powerful of these is the Tweezer Bottom Candlestick Pattern. It’s a standout tool for spotting bullish reversals with remarkable precision. Whether you’re working with a regulated forex broker or navigating the stock markets, understanding this pattern can dramatically improve your trading decisions and profitability.

This guide explores the Tweezer Bottom Candlestick Pattern meaning, effective trading strategies, and real-world examples. Get ready to equip yourself with expert insights and elevate your trading game.

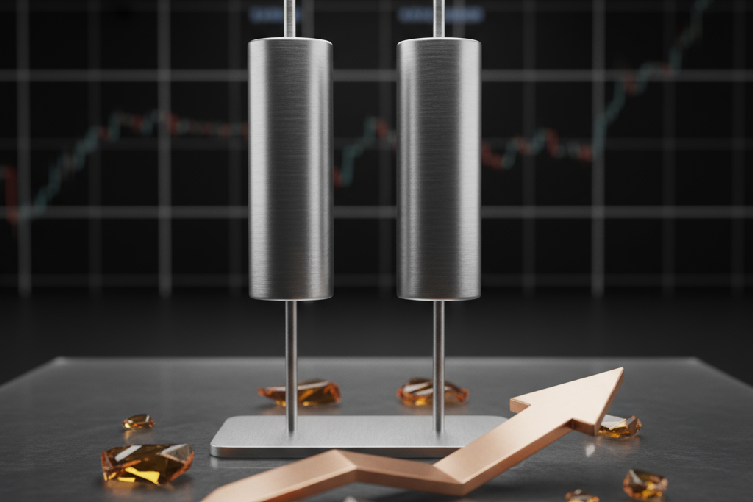

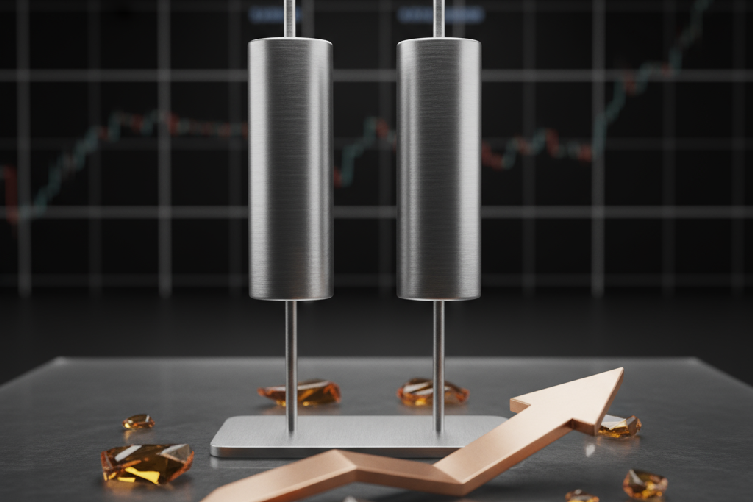

What is the Tweezer Bottom Candlestick Pattern?

The Tweezer Bottom is a bullish reversal indicator signaling a potential shift from a downtrend to an uptrend. It’s composed of two or more consecutive candles that share matching or nearly matching lows. This formation suggests that selling pressure is fading and buyers are starting to step in.

Traders see this pattern as a reliable signal to consider entering long positions in anticipation of a price increase. By recognizing it, you can better anticipate market reversals and make informed decisions that align with an emerging bullish trend.

Visual Characteristics of the Pattern

Visually, the Tweezer Bottom pattern is easy to spot once you know what to look for. Here are its key characteristics:

- Two Consecutive Candles: Both candles have similar or identical low points, creating a “tweezer” effect that shows a balance between buyers and sellers.

- Opposite Wicks: The candles might have different wicks, showing varying levels of buying and selling pressure during the sessions.

- Bullish Confirmation: The second candle often closes higher than the first, which reinforces the reversal signal.

- Location at Support: The pattern typically forms at significant support levels where the price has previously reversed, boosting its reliability.

- Extended Downtrend: The market has been in a prolonged bearish phase, which exhausts selling momentum.

- Decreasing Volume: A drop in trading volume often suggests that selling pressure is weakening, allowing buyers to accumulate positions.

- Consolidation Period: After a significant drop, prices may stabilize, reflecting trader indecision and creating a prime opportunity for a reversal.

- Support Level Interaction: The pattern is most powerful when it forms near an established support level where buying interest has historically been strong.

Understanding the Formation

The Tweezer Bottom doesn’t appear randomly. It’s influenced by specific market conditions that set the stage for a reversal.

Conditions that lead to Tweezer Bottoms include:

The Market Psychology Behind the Pattern

The Tweezer Bottom pattern perfectly captures a critical shift in market sentiment. At first, sellers are in control, confidently pushing prices down. As the pattern forms, however, buyers start gaining confidence, sensing that the selling pressure is almost gone.

This psychological tug-of-war between bears and bulls creates a balance, resulting in the matching lows. When the subsequent bullish candle appears, it signifies that buyers are officially stepping in, ready to reverse the trend and push prices higher.

Components of the Tweezer Bottom Candlestick Pattern

To trade this pattern accurately, it’s essential to understand its two core components.

The First Candle

A bearish candle signals ongoing selling pressure with a long body. It establishes the initial low of the pattern and highlights the exhaustion of the sellers as they fail to push the price lower.

The Second Candle

A bullish candle shows renewed buying interest, closing higher than the first candle and signaling a momentum shift. Its low matches the first candle’s low, indicating that sellers could not break the support. Bullish confirmation is solidified when this second candle closes higher, proving that buyers have taken control.

By understanding the Tweezer Bottom pattern’s structure, psychology, and formation, you can add a reliable tool to your trading arsenal, helping you spot high-probability reversals and improve your overall profitability.