How Much Capital Do You Need for Day Trading?

Many aspiring traders wonder how much money is truly needed to start day trading. In the U.S., a federal regulation, known as the Pattern Day Trader (PDT) rule, requires a minimum account balance of $25,000 for day traders in securities markets. This rule is mandated by FINRA. To avoid this limitation, traders must maintain their account balance above this $25,000 threshold.

However, for FX day trading, many experienced firms recommend starting with at least $100–$500. This smaller amount allows traders to effectively manage risk by using appropriate leverage and position sizes. The exact capital required ultimately depends on several factors: the trader’s individual strategy, their risk tolerance, and the specific markets they choose to trade. Generally, more capital provides greater flexibility and a larger margin for error.

What Exactly is Day Trading?

Day trading has become a widely discussed topic. Some view it as a fast track to wealth, while others caution about the significant risks, noting that many have lost substantial capital. It’s crucial to approach day trading with caution, especially when dealing with leveraged instruments or investment strategies.

Regardless of your experience, day trading is a demanding and inherently risky investment activity. You should only engage in day trading if you thoroughly understand the risks involved, along with the economics and performance of leveraged investing methods, such as utilizing options, leveraged products, or trading on margin.

Day trading involves buying and selling financial instruments within the same trading day. The goal is to profit from small, rapid price fluctuations. Day traders often use leverage to control larger positions, which can amplify both gains and losses. This fast-paced, speculative approach demands constant market monitoring and staying updated on news. Successful professional day traders typically possess extensive experience and a deep understanding of risks, products, markets, and various trading techniques. Always be aware of the substantial risks before engaging in any form of trading.

How to Begin Your Day Trading Journey

Starting day trading successfully involves several key steps:

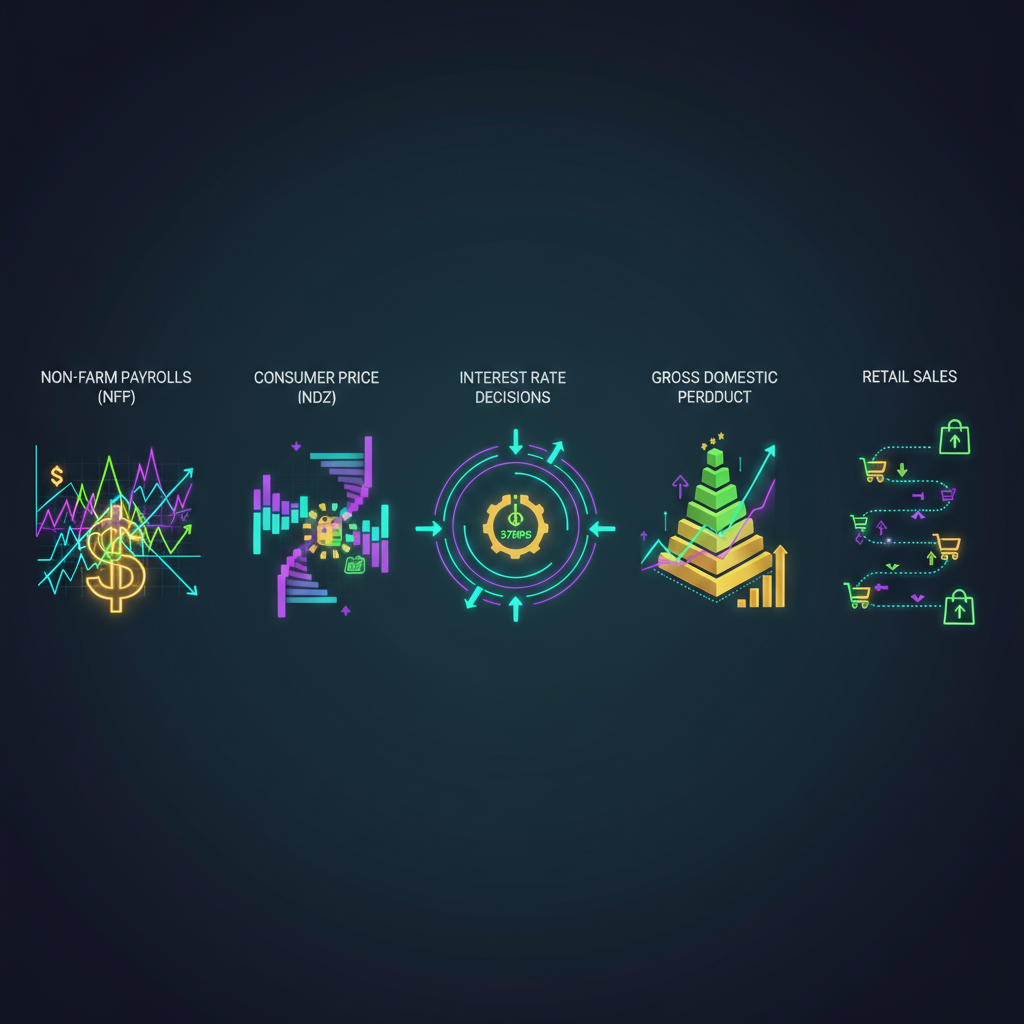

- Develop Deep Market Expertise: While strong technical analysis skills are valuable, it’s also essential to have a profound understanding of the markets, sectors, and assets you trade. This includes knowing the primary drivers, risks, regulations, and dynamics of each market. Experienced day traders develop an intuitive feel for market behavior, enabling them to spot emerging trends and patterns. This is built through extensive training, research, and diligent observation.

- Stay Informed and Manage Risk Responsibly: It’s vital to stay current with news, economic data, and novel trading strategies. Ensuring you have adequate risk capital is paramount. Due to the high degree of risk involved in day trading, you should only trade with funds you can genuinely afford to lose. A common mistake is losing an entire trading account.

- Maintain Adequate Trading Capital to Manage Risk and Emotions: The amount of capital needed varies based on the assets and trading method used. Volatile markets with higher leverage require larger accounts to withstand potential drawdowns. Sufficient capital allows traders to size their positions correctly and prevents sudden price swings or margin calls from forcing them out of trades. This emotional discipline is crucial for making rational trading decisions.

- Regulatory Compliance: Adhering to minimum account balance regulations is another critical aspect, especially for meeting regulatory capital requirements for day traders. On the FXNX platform, we prioritize responsible trading practices, ensuring our users have the tools to manage their capital effectively.

* Instead of trying to trade every market, focus on becoming an expert in one or a few related areas. Markets are constantly evolving, and specialized knowledge offers more opportunities to capitalize on subtle changes.

Always remember, day trading carries significant risk, and it’s essential to be well-prepared and informed. FXNX insights suggest that thoughtful preparation is key to navigating these markets.