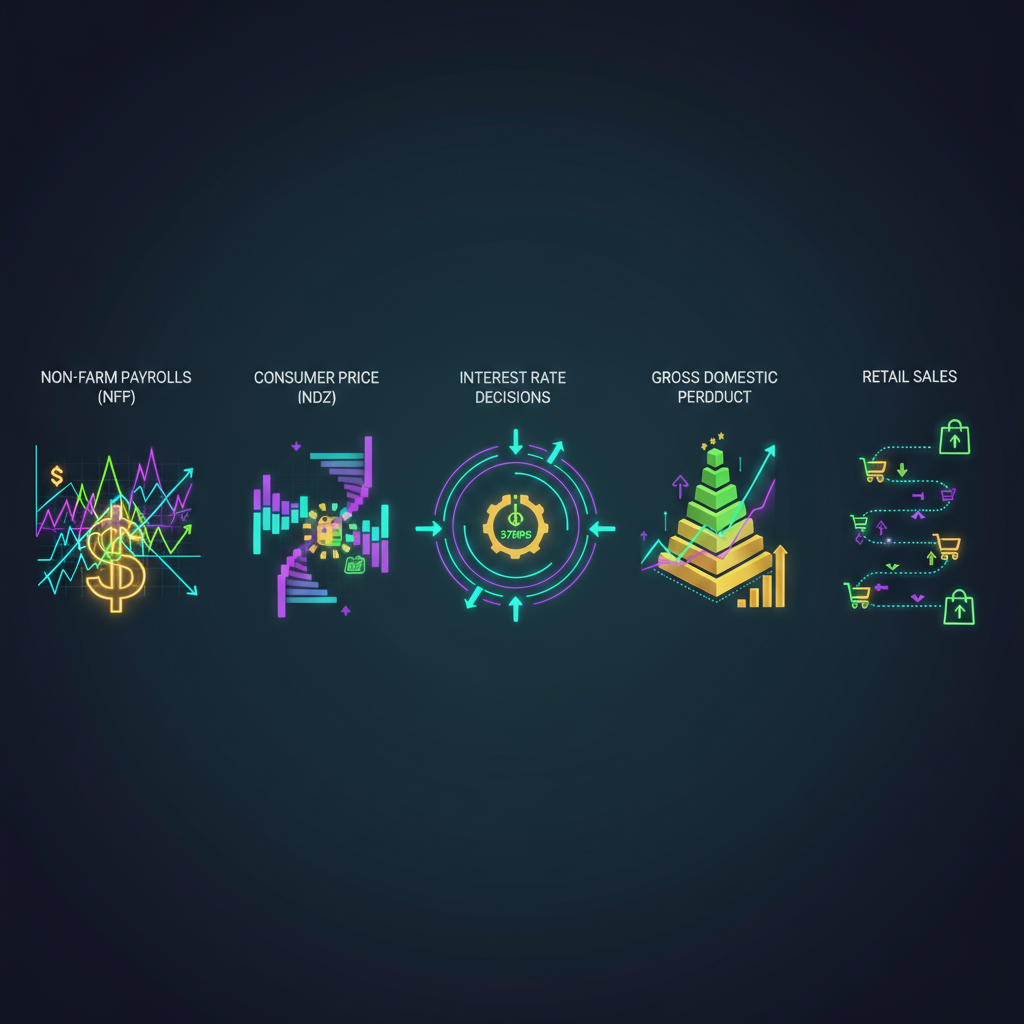

5 Economic Reports That Could Be a Forex Trader’s Worst Nightmare

Ever felt like the forex market is playing tricks on you? You’re not alone! As traders, we’re always on the lookout for that perfect moment to make our move. But what if some economic reports could flip your carefully planned strategy on its head?

Buckle up, because we’re about to dive into the wild world of economic indicators that might just challenge even the most experienced forex traders.

Why Should You Care About These Reports?

Picture this: You’re sitting at your desk, sipping your morning coffee, feeling confident about your latest trade. Suddenly, an economic report drops, and boom! The market goes haywire. Sound familiar?

That’s the power of these economic titans we’re about to explore. By the end of this article, you’ll be armed with the knowledge to navigate these tricky waters like a pro. Ready to turn potential market challenges into golden opportunities? Let’s jump in!

1. Non-Farm Payrolls (NFP): The Job Market Rollercoaster

Have you ever wondered why the first Friday of each month sends forex traders into a frenzy? Enter the Non-Farm Payrolls report, often considered the granddaddy of economic indicators!

What’s the Big Deal?

The NFP report gives us a snapshot of the US job market, excluding farm workers and a few other categories. It’s like taking the pulse of the world’s largest economy. This report doesn’t just tell us how many jobs were added or lost; it also provides data on average hourly earnings and the unemployment rate.

All of these factors can influence the central bank’s monetary policy decisions, which in turn can cause significant movements in the forex market. Understanding these movements is key for FXNX traders.

Why it Could Be a Nightmare

Imagine you’ve placed a trade expecting the dollar to strengthen. Then, out of nowhere, the NFP report shows fewer jobs were added than expected. Suddenly, your trade is swimming against the current!

- The market can swing wildly in moments, leaving unprepared traders in a cold sweat.

- NFP often comes with revisions to previous months’ data, adding another layer of complexity to market reactions.

- Stay informed about market expectations for the NFP.

- Consider closing or reducing positions before the report’s release.

- Be ready to act quickly if the numbers surprise the market.

- Don’t forget to look at the whole report, not just the headline number.

- Keep an eye on revisions to previous months’ data.

- It’s not just the actual decision that matters.

- The central bank’s forward guidance – their hints about future policy – can be just as impactful. A slight change in wording in their statement can send the market into a tizzy.

- Keep an eye on economic indicators that might influence the central bank’s decisions.

- Listen carefully to central bank speeches for clues about future policy.

- Don’t put all your eggs in one basket – diversify your trades!

- Pay attention to the “dot plot” or similar long-term forecasts of interest rates.

#### Real-Life Example:

Remember August 2011? The NFP report showed zero job growth. The forex market went into a tailspin, with the dollar dropping significantly against major currencies. Traders who weren’t prepared faced significant losses.

However, it’s not always bad news that causes volatility. In November 2009, when the NFP showed a much smaller job loss than expected (-11,000 vs. -125,000 forecast), the dollar surged against other major currencies, catching many traders off guard.

How to Prepare:

2. Federal Reserve Interest Rate Decisions: The Market Mover

Ever noticed how the entire financial world seems to hold its breath when the central bank for the US economy speaks? There’s a good reason for that!

What’s at Stake?

The central bank’s interest rate decisions can send shockwaves through the forex market. It’s like they are the conductor, and interest rates are the music – when they change the tune, everyone on the dance floor feels it!

Interest rates affect everything from borrowing costs to investment returns, and they play a crucial role in determining the relative value of currencies. A higher interest rate typically makes a currency more attractive to investors, as it offers better returns on investments denominated in that currency.

Why it Could Spell Trouble

Let’s say you’re betting on a rate hike, but the central bank decides to hold steady. Suddenly, your carefully planned trade could go south faster than you can say “quantitative easing”!

#### A Tale from the Trenches:

Cast your mind back to March 2020. As the pandemic hit, the central bank slashed rates to near zero in an emergency move. The dollar went on a wild ride, surging against some currencies and plummeting against others. Many traders were caught off guard, facing significant losses on the FXNX platform.

On the flip side, in December 2015, when the central bank raised rates for the first time in nearly a decade, the market reaction was relatively muted because the move had been well telegraphed. This shows the importance of not just the decision itself, but how well it aligns with market expectations.

Leave a Reply